Expiration for CFD instruments on Libertex accounts

A futures contract is an obligation to buy or sell an underlying asset at a certain time in the future at the price set today.

In Libertex trading platform, the trader is given the opportunity to trade CFDs on futures contracts. CFD (contract for difference) is a financial instrument that allows you to make a profit depending on the price fluctuations of the underlying asset that is at the basis of the contract without having the asset itself.

Terms of trade with CFDs on futures contracts:

- Commission for the trade. The amount of commissions for CFD trades on futures contracts can be found in the specifications of the instruments in the Indices, Energy, Agricultural and Metals groups.

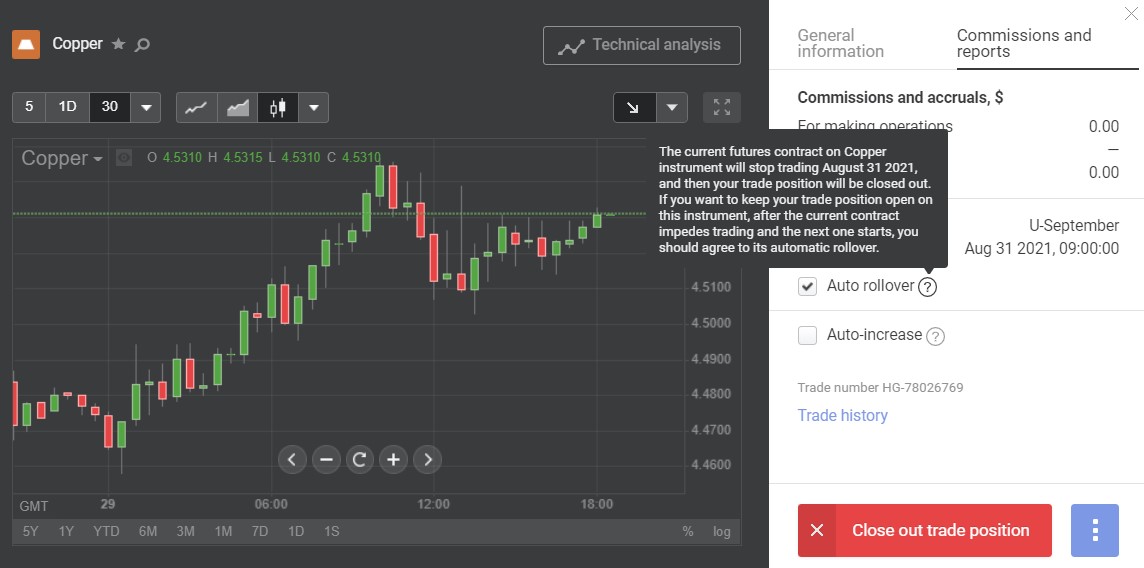

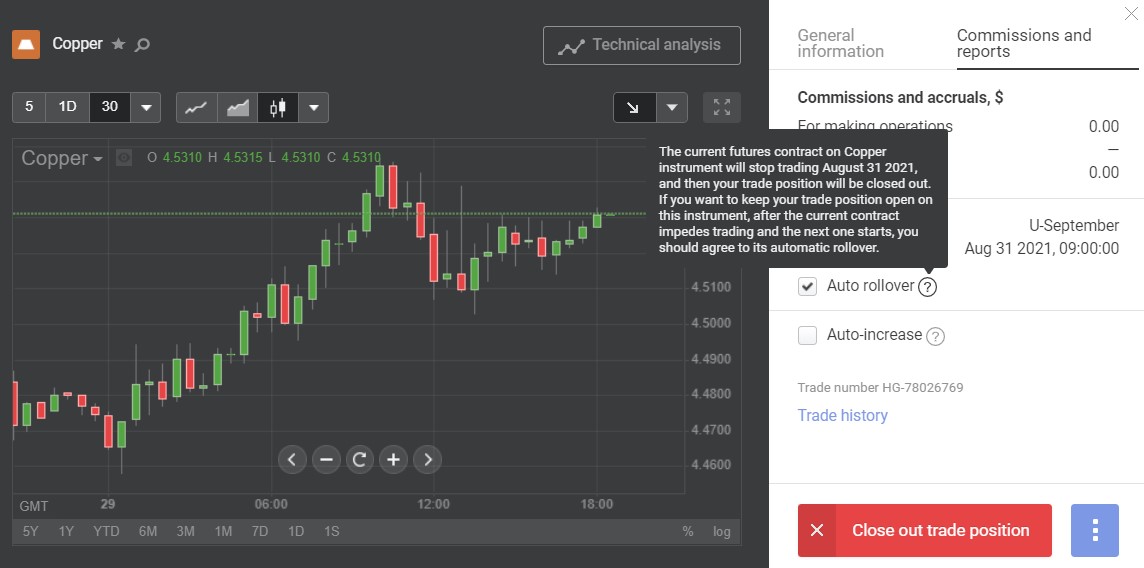

- Futures have expiration date (expiration), on the approach of this date all transactions in the relevant contract are canceled. Expiration dates of futures contracts can be found in the specifications of the instruments on the company's website. It's important to mention that at the time of the expiration all pending orders are removed.

Important: Due to the fact that in the last days of the existence of the futures contract liquidity is greatly reduced, the company makes a transition to the nearest circulating futures before the expiration date of the current contract on the stock exchange.

In order for traders to be able to hold long-term trades on CFDs on futures contracts, they are given the option of automatic prolongation of the trade.

The procedure of prolonging the trade is as follows:

- At the time of the expiration of the futures contract, the financial result of the trade is fixed;

- In fact, the trade closes at the last actual price of the contract;

- There is a technical change of the "old" contract by the "new" contract, which has other quotes;

- The trade is attached to a new contract. In this case the trade amount and the multiplier value are remained. Technically, a new trade opens into a new contract, therefore, spread is charged for the operation.

- When the contract is prolonged (transferred), a new opening price is calculated so that the "financial result before the expiration" would have been fixed when the first actual price of the new contract is received

If you want to check the calculation of the new opening price, you can use the following formula:

NewOpenRate '=' NewContractPrice '*' LastOpenRate '/' ExpLastPrice 'where,

NewOpenRate - the new price for opening a deal;

NewContractPrice - the first price of a new contract after expiration;

LastOpenRate - the previous price for opening a trade;

ExpLastPrice is the last price of the previous contract.

A futures contract is an obligation to buy or sell an underlying asset at a certain time in the future at the price set today.

In Libertex trading platform, the trader is given the opportunity to trade CFDs on futures contracts. CFD (contract for difference) is a financial instrument that allows you to make a profit depending on the price fluctuations of the underlying asset that is at the basis of the contract without having the asset itself.

Terms of trade with CFDs on futures contracts:

- Commission for the trade. The amount of commissions for CFD trades on futures contracts can be found in the specifications of the instruments in the Indices, Energy, Agricultural and Metals groups.

- Futures have expiration date (expiration), on the approach of this date all transactions in the relevant contract are canceled. Expiration dates of futures contracts can be found in the specifications of the instruments on the company's website. It's important to mention that at the time of the expiration all pending orders are removed.

Important: Due to the fact that in the last days of the existence of the futures contract liquidity is greatly reduced, the company makes a transition to the nearest circulating futures before the expiration date of the current contract on the stock exchange.

In order for traders to be able to hold long-term trades on CFDs on futures contracts, they are given the option of automatic prolongation of the trade.

The procedure of prolonging the trade is as follows:

- At the time of the expiration of the futures contract, the financial result of the trade is fixed;

- In fact, the trade closes at the last actual price of the contract;

- There is a technical change of the "old" contract by the "new" contract, which has other quotes;

- The trade is attached to a new contract. In this case the trade amount and the multiplier value are remained. Technically, a new trade opens into a new contract, therefore, spread is charged for the operation.

- When the contract is prolonged (transferred), a new opening price is calculated so that the "financial result before the expiration" would have been fixed when the first actual price of the new contract is received

If you want to check the calculation of the new opening price, you can use the following formula:

NewOpenRate '=' NewContractPrice '*' LastOpenRate '/' ExpLastPrice 'where,

NewOpenRate - the new price for opening a deal;

NewContractPrice - the first price of a new contract after expiration;

LastOpenRate - the previous price for opening a trade;

ExpLastPrice is the last price of the previous contract.